For investors in India, Alternative Investment Funds (AIFs) have become a promising alternative to traditional assets. High net worth individuals (HNIs) can diversify their investment portfolios thanks to them.

Although AIFs have the potential to yield higher returns, investors need to be mindful of the tax ramifications of making these kinds of investments. They are crucial in determining which AIF category to invest in.

We will explore the taxation of AIF in India in this blog, providing you with an understanding of the taxation of these special investment vehicles and the important factors to take into account as an investor.

What is an AIF?

A private pooled investment vehicle known as an Alternative Investment Fund, or AIF, makes investments in alternative asset classes like derivatives, real estate, commodities, hedge funds, private equity, and hedge funds. Because the investment amount in AIFs is significantly higher, HNIs (high net worth individuals) and institutions typically invest in them.

The Securities and Exchange Board of India, or SEBI, oversees AIFs. An alternative investment fund (AIF) may be established as a trust, company, limited liability partnership, or corporate body in accordance with the SEBI (Alternative Investment Funds) Regulations, 2012. Nonetheless, trusts are the legal structure for a large number of AIFs that have been registered with SEBI.

Who can invest in an AIF?

The requirements for investing in AIF are as follows:

- Investors in these funds may include foreign nationals, Indian residents, and NRIs (non-residents of India).

- AIF is also available for joint investment. They could be an investor’s spouse, parents, or kids.

- A minimum investment of Rs. 1 crore is required from investors. This cap is Rs 25 lakh for fund managers, employees, and directors.

- AIFs typically have a three-year minimum lock-in period.

- A maximum of 1,000 investors can be included in each scheme. But there is a 49-cap in the case of angel funds.

Why invest in AIFs?

For certain investors looking for alternatives to traditional asset classes like stocks and bonds and diversification as well as the possibility of higher returns, AIFs may be an appealing choice.

Investors may want to think about making an AIF investment for the following reasons:

- Possibility of Higher Returns: Because AIFs are exposed to a wider range of assets and investment strategies than traditional investments, they may provide higher returns than the latter. But there’s a higher risk associated with this higher return.

- Diversification: Portfolio diversification is facilitated by alternative investment funds (AIFs), which provide investors with access to hedge funds, real estate, and private equity, among other asset classes.

- Low Volatility: Compared to other investments, such as equity or mutual fund investments, AIFs are less volatile because they are not correlated with the stock market.

Taxation of Alternative Investment Funds

Since each AIF category is a distinct investment vehicle, they are all taxed in unique ways. Investors should, therefore be aware of the income tax ramifications of AIFs. Income from Category I and II AIFs (apart from business income) is subject to taxation at the investor’s applicable tax rate.

In contrast, income from Category III AIFs is tax-free at the investor’s level because these AIFs are not granted a pass-through status, meaning that the fund is responsible for paying the tax. Let’s examine the tax laws pertaining to AIFs in more detail.

Category I and II AIFs:

Category I and II AIFs have been granted a pass-through status under the special taxation regime introduced by the Finance Act of 2015. If a fund is pass-through, investors will pay taxes on the income it generates rather than the fund as a whole. In this case, the investor is responsible for paying taxes on the income from the investment.

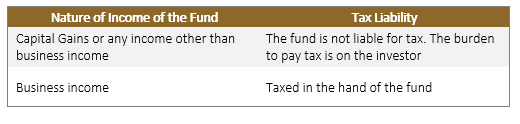

The fund is not subject to any taxation on investment income or capital gains; however, if the income it generates is classified as business income, it will be responsible for paying taxes on it.

The following table will aid in a better understanding of the tax structure:

1. Long-Term Capital Gains (LTCG): Investments in Category I and II AIFs held for more than a year are categorised as long-term capital gains and are taxed at the long-term capital gain tax rate. Generally, unlisted shares and other assets are subject to a 20% tax on long-term capital gains, while listed shares are subject to a 10% tax.

2. Short-Term Capital Gains (STCG): Depending on the investor’s tax bracket, short-term capital gains from Category I and II AIFs are typically taxed at the appropriate short-term capital gains tax rate. Short-term capital gains are generally subject to a 15% tax rate.

3. Dividend Income: An investor’s tax slab will determine how much of their dividends are taxable.

4. Interest Income: Any interest income received from Category I and II AIFs is taxable depending on the investor’s tax slab.

AIFs in Category III

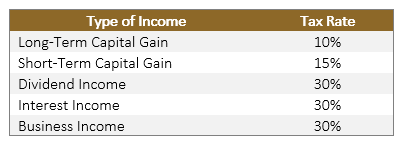

Any income, including business, capital gain, and investment income, is subject to fund-level taxation. Category III AIFs are not covered under the pass-through tax regime.

The AIF bears the tax on all four income categories, albeit at varying rates.

The summary of taxes that apply to Category III AIFs is provided below:

Bottom Line

With their potential for greater returns and diversification, Alternative Investment Funds (AIFs) have made a name for themselves in the Indian investing scene. Nonetheless, in order for investors to maximise their tax strategies and make well-informed decisions, they must comprehend how AIFs are taxed.

Investors selecting the best AIF for their portfolio should carefully consider their investment goals and risk tolerance, as the tax mechanism that AIFs follow varies depending on the category invested in. To optimise your AIF investments and efficiently manage your tax liability, you must seek professional guidance and adhere to tax regulations.

Assetmonk is a pioneer in alternative real estate investment, and we understand the immense potential in the Indian commercial real estate industry. We make alternative assets, such as real estate, more accessible. We have customized investment options to suit individual financial goals like passive income, capital appreciation and portfolio diversification.

Our expertise is identifying opportunities with high yields within the retail, office, and industrial asset classes. This enables our investors to maximize profits while diversifying their portfolios.

We offer various alternative investment options, such as fractional or joint ownership of high-end commercial properties, sub-leasing ventures, etc. Trophy locations with the potential for high Internal Rates of Return (IRR) are prioritized, and due diligence is done to ensure these provide profitable returns for our investors.

FAQs

Q1. What are the tax implications for Alternative Investment Funds (AIFs) in India?

A. AIFs in India are subject to various tax regulations. Income earned by AIFs is classified as capital gains or business income, depending on the nature of the investment. Capital gains are taxed at different rates based on the holding period, while business income is subject to the applicable corporate tax rate.

Q2. Are there any specific tax treatment or exemptions available for AIFs in India?

A. Yes, certain exemptions are available for AIFs. For example, Category I and II AIFs registered with the Securities and Exchange Board of India (SEBI) enjoy pass-through status, meaning they are not taxed at the fund level. Instead, the income is taxed directly in the hands of the investors based on their individual tax rates.

Q3. What are the compliance requirements for AIF taxation in India?

A. AIFs must adhere to various compliance requirements related to taxation. This includes obtaining a Permanent Account Number (PAN), filing income tax returns, maintaining appropriate accounting records, and complying with the provisions of the Income Tax Act, 1961.

Q4. How are capital gains taxes calculated for AIFs in India?

A. Capital gains tax for AIFs is determined based on the holding period of the investment. Short-term capital gains (held for less than 36 months) are taxed at the applicable income tax slab rates, while long-term capital gains (held for 36 months or more) are subject to a flat tax rate.

Q5. Can AIFs avail tax planning strategies in India?

A. Yes, AIFs can employ various tax planning strategies to optimize their tax liabilities. These may include structuring investments in a tax-efficient manner, utilizing tax incentives and exemptions, and engaging in appropriate tax planning strategies within the legal framework.

Listen to the article

Listen to the article